Securing finance for a construction project can be a daunting challenge. Answering the tough questions posed by financiers — such as Is the project financially feasible?, Do you have all the necessary approvals and documents from relevant authorities?, and Is your project located in a designated special zone? — often becomes a major obstacle.

But you don’t need to worry. Simply engage with us, and we’ll make your fundraising journey smooth and hassle-free.

Whether it's a redevelopment project, an SRA project, or a brand-new development, we can arrange financing to meet all your construction needs. Even at the IOD (Intimation of Disapproval) stage, we can secure funding of up to 60% of the total project cost. We identify suitable funding sources, assist you in preparing application documents, and represent your case to banks, NBFCs, and private financiers — always acting in your best interest.

In addition to construction funding, we also represent builders and developers before our associated banks and NBFCs for project approvals (APF/PA), streamlining the home loan process for their end users and customers.

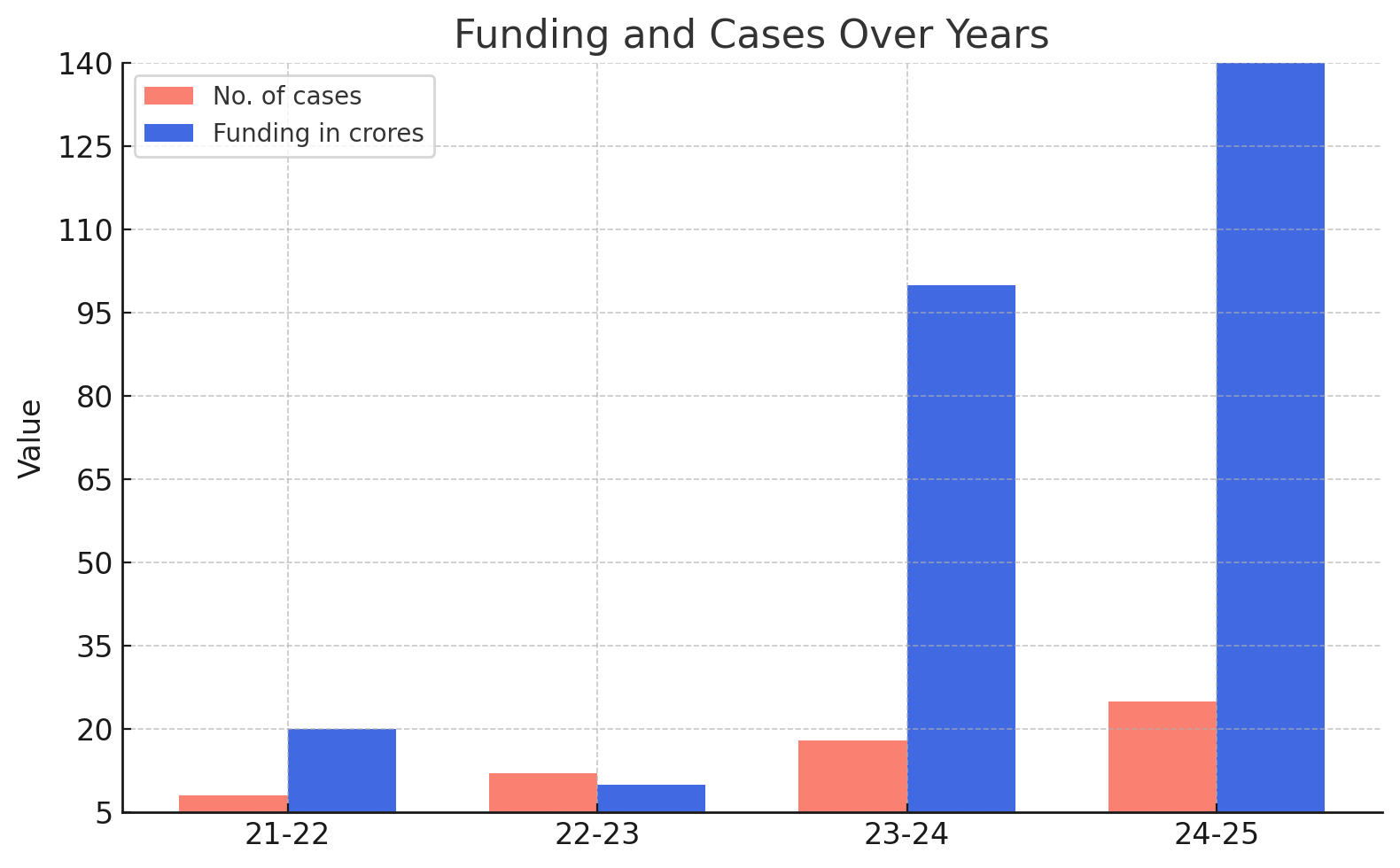

Our Construction Funding Trajectory

From 5 crores in F.Y 2021-22; till date, we have successfully raised over 140 crores funding for construction projects of our clients in Mumbai, Navi Mumbai and Pune.

Why Us?

We believe that when the need is genuine, the documentation is complete, the project plan is credible, and the presentation is strong, there should be no reason for a case to be rejected. That’s why we support our clients in the following ways:/p>

- Setting the right expectations

- Arranging the required documents

- Preparing and presenting the plan

- Raising the funds at the best possible rates